Hydrogen in China

Please select the region you are interested in

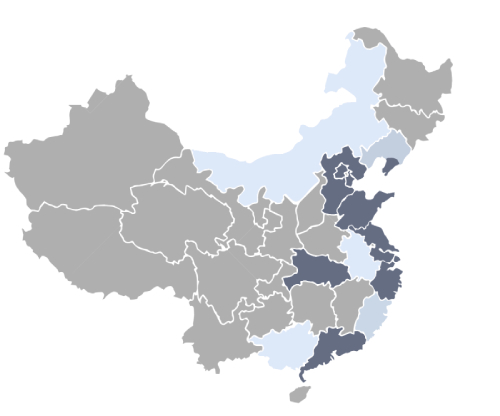

From North to South:

Beijing greater area

Dalian

Shandong

Yangtze River Delta (Shanghai)

Wuhan

Guangdong

Hongkong

Bigger Beijing region

Next to being the center of the Chinese government, the city of Beijing also hosts a variety of research institutes and head offices of big state-owned energy developers. These companies increasingly shift their investments towards the hydrogen domain.

Beijing

- Last August Beijing released a new hydrogen five-year plan (2020-2025). It shows that Beijing aims to develop an international fuel cell vehicle supply chain, and to further industrialize the hydrogen sector. To give an idea of the ambitions: by 2025 China aims to have more than 10,000 fuel cell vehicles on the road and by 2050 hydrogen will account for over 10% of China’s energy system.

- In order to reach those goals the Chinese government designates certain areas as special zones where companies involved in the industrial supply chain (from equipment manufacturing and transportation to application demonstration zones) will be clustered together. This will also be expanded to the broader Beijing-Tianjin-Hebei region, whereby cross-regional collaboration is stimulated.

- An example of one of those areas is the Beijing Economic Development Zone. Within this areas there is a focus on the automotive industry and several (foreign) companies are already present in this area. Activities vary and there is a strong emphasis on R&D: in 2020 the United Fuel Cell System Research and Development (Beijing) Co., Ltd. was established. With this company six well-known automotive companies (Toyota Motor, FAW, Dongfeng, GAC, BAIC and Beijing Yihuatong) joined forces in the R&D hydrogen domain.

Northern China

- Beijing is mostly surrounded by the province Hebei. Hebei is a wind rich province which makes it a strategic province for the production of green hydrogen. In 2020 the provincial government released a list of 43-hydrogen related projects and marked it is a key priority. Next to green hydrogen production sites, also demonstration and research projects are being executed. One project – implemented by a Chinese engineering company- aims to develop a long-distance pipeline project in Hebei, which will be the longest pipeline in China (145km).

- Hebei province is hosting the Winter Olympics next February and is seeing this as an opportunity to position itself as a global new energy frontrunner. The city-level government aims to make the city Zhangjiakou a first-class hydrogen energy city and an internationally well-known hydrogen energy capital by 2035. Investments will be made and the city’s cumulative output value of the energy and related industries are aimed at 170 billion RMB by 2035.

- Due to its large onshore wind capacity Zhangjiakou supplies green power to Beijing. However, it still has a lot of (unused) capacity left that could be used for the production of green hydrogen. Next to the production, also a lot of attention is being paid to the use of hydrogen in transportation. It is expected that the majority of vehicles being used during the Olympics will be hydrogen-driven.

- Furthermore, it should not be forgotten that Hebei province is an important province for the heavy iron & steel and petrochemical industries. With the increasing focus on decarbonizing these industries, it is likely that hydrogen will also play a growing role in these processes.

- The other northern provinces, Ningxia and Inner Mongolia, need to be mentioned since they have a lot of solar and onshore wind potential. In both provinces there are a lot of solar and onshore wind projects on-going and in the future it can be used for green hydrogen production. Nevertheless, both provinces are in the initial stage regarding hydrogen developments and are less active in this domain in comparison to Hebei.

Opportunities for Dutch companies

- At the moment hydrogen production in China is mainly from natural gas and coal (grey hydrogen). With the current decarbonisation ambitions, more attention is paid towards the production of green hydrogen and R&D is being conducted on the production of hydrogen with using renewable energy.

- Ensuring safety remains one of the biggest challenges with the application of hydrogen. Solutions to this are generally welcomed and there is a lot of interest in advanced storage and transfer-related technologies and innovations.

- During the past few years many companies and research institutes devoted their hydrogen activities towards the transportation sector. This is slowly changing and other sectors, such as the heavy industries, are receiving more attention. This can result in windows of opportunities for Dutch companies.

Paheerya Yushan

Yangtze River Delta Region (Shanghai)

In June 2020, Shanghai positioned first in the China ‘hydrogen urban competitiveness ranking’, which indicates which cities have the best hydrogen infrastructure, policies and commercial environment. It is the combination of government support, enterprises, universities, and 20 years of R&D that put Shanghai in the lead. Opportunities are not limited to Shanghai, but cover the whole Yangtze River Delta. This region hosts China's first R&D and demonstration areas for hydrogen Fuel Cell Vehicles FCVs, great hydrogen production potential and China’s largest chemical park.

Local Strengths

- Fuel Cell Vehicles (FCV) Shanghai and the Yangtze River Delta region have formed a relatively complete hydrogen and fuel cell industry chain, with upstream hydrogen storage and transportation infrastructure, middle fuel cell stacks/systems, core component manufacturers and downstream industrial facilities. The local government is actively rolling out policies to further support FCV industry development. During the biggest FCV expo last June in Shanghai it was announced that Shanghai would take the lead in a major FCV multi-city demonstration zone covering Suzhou, Nantong, Jiaxing, Zibo, Ordos, and Ningxia Hui Autonomous Region, funded by the Ministry of Finance. As of September 2020, there are 1,955 hydrogen fuel cell vehicles running in Shanghai, which is planned to increase to 10.000 in 2023. Shanghai has currently 10 hydrogen refueling stations and plans to reach 30 stations by 2023, and 70 by 2025.

- Hydrogen Production In the Yangtze River Delta region, and especially in Jiangsu province, an increased focus on the production of green hydrogen with offshore wind energy is visible. Jiangsu province has the largest offshore wind capacity in China and plans to expand this even more in the upcoming five years. As part of the broader clean energy goals local Chinese authorities are looking at developing green hydrogen production sites at the offshore wind farms. This could provide opportunities for Dutch companies.

- Chemistry China does not only focus on hydrogen production from renewable resources, but also on hydrogen from industrial by- products. Shanghai has the country's largest chemical industry park (SCIP) which produces high volumes of hydrogen by-product. SCIP actively seeks opportunities to further exploit their hydrogen streams and together with China's largest automobile manufacturer, SAIC Motor, they opened the most-advanced refueling station of China in their park. Opportunities & challenges for Dutch companies.

Opportunities & challenges for Dutch companies

- Despite the long history of the region in FC development, the Netherlands is in many fields still technologically ahead. Chinese companies seek international collaborations to improve their products.

- Many international (including European) companies are already present in this region, meaning there is also international competition. For this reason, it might be easier for Dutch companies with an already proven track record.

- Dutch companies can also apply for subsidies as long as they work together with a local partner.

Fleur Edens

Marita Mitrovic

Guangdong

Guangdong is the region in which most hydrogen companies are registered. The developments of hydrogen policies and projects in Guangdong are among the most advanced and mature in the country, mainly due to the much earlier start compared to other cities and regions. Within the Guangdong region there are three cities famous for their hydrogen developments. Foshan, Guangzhou and Maoming. Several Dutch Dutch companies are already active in this region, such as NedStack, Teesing and KIWA SHV and Shell; the latter three also having established offices here.

Local Strengths

- Mature hydrogen transportation network. In the city of Foshan is leading in China when It comes to hydrogen as application in mobility. There are already 1000 active h2 buses, 400 active delivery hydrogen trucks, 1 hydrogen tram and 20 active hydrogen refueling stations. In Guangdong province, the local government has allocated 30% of its total subsidy budget to hydrogen fuel cells and vehicles.

- Support from central government. The China central government assigned the province of Guangdong to be the leading province for hydrogen developments. The city of Foshan was assigned as the major fuel cell hub and the city of Maoming has production base. The UNDP organizes yearly one of China’s largest hydrogen conferences in Foshan together with the local government.

- Complete industrial supply chain. By attracting several large, medium, and small scale enterprises, Foshan and Guangzhou offer a nearly complete hydrogen industrial supply chain, with production of fuel cell vehicles, core parts such as the fuel cell stacks, storage & transportation equipment, and refueling stations. For hydrogen production, the city of Maoming a well know player with its large petrol-chemical plant.

Opportunities & challenges for Dutch companies

- Local governments are very open to discuss with international parties for their hydrogen developments. A great example of this is the Dutch company SHV who has already two active Hydrogen Refilling Stations in Guangzhou.

- Despite all recent hydrogen technology developments, Dutch technology is still leading, creating many opportunities for Dutch companies in regions with many active hydrogen projects such as South China.

- In Guangdong there is currently the project “Green Pearl River Programme” ongoing. The provincial government is looking to make its inland shipping more green and is considering hydrogen as one of the main ways to achieve this.

- Policies and local government leaders can change suddenly or over-time which can impact the hydrogen developments in unforeseen ways. But, because of the central government’s 2060 carbon-neutral plans, the general direction of using more sustainable energy sources won’t change.

- Finding a local reliable partner can be hard and its importance cannot be underestimated. Our team in Guangzhou is happy to help with this step

Karin Han

Fons Klein Tuente

Dalian

The economy of Dalian is heavily dependent on the oil and petrochemical industry. Local authorities have ambitious plans to develop a separate hydrogen economy. The development of the local hydrogen sector in the responsibility of the Dalian Development and Reform Commission. In 2021, Dalian counts 13 hydrogen related projects under construction. Dalian has 2 operational fueling stations, and another 2 are being built. Furthermore, 7 hydrogen related industrial zones are under construction.

Local Strengths

- Innovation capability. The Dalian Institute of Chemical Physics, Chinese Academy of Science (DICP) is one of the first institutes in China to start developing the fuel cell technology. The leading Chinese fuel cell companies such as Sunrise Power and Mixwell Technology are all from Dalian. Their technology was originally developed at DICP. In addition, the University of Chinese Academy of Sciences Energy College was newly built in Dalian high-tech zone. The main goal of the university is to stimulate R&D on hydrogen and clean energy development.

- Hydrogen manufacturing capability. The petrochemical industry is one

of the leading industries in Dalian. Local petrochemical companies produce roughly 700’000 – 800’000 tons hydrogen by-product per year. The manufacturing capability makes the price of local hydrogen cheaper compared to other cities in China.

- Support from local government. To increase the support for the development of the hydrogen energy industry, the Dalian government will invest 1 billion CNY in the coming five years. Government subsidies will be granted to hydrogen-energy vehicles, ships, key components, fueling stations, etc.

Opportunities & challenges for Dutch companies

- The development of hydrogen in Dalian is relatively new. The region offers many new projects, but most projects are dominated by government parties. It might be challenging for Dutch SMEs to get involved.

- Dutch companies can only apply for local government subsidies when they intend to invest locally, e.g. manufacture equipment locally. If the company merely wants to sell their technology or equipment, they will not qualify for government financial support.

- Companies that are already active in China, i.e. have a proven track record, are preferred.

- Companies without a proven track record, might be interested to apply for a demonstration project (DHI) to promote their Dutch hydrogen expertise.

Ms. Carolina de Velde

Chief Representative

Netherlands Business Support Office (NBSO) China, Dalian

[email protected]

Shandong

Shandong is the 3rd largest economic powerhouse in China and a top energy producer and consumer. Shandong has rich hydrogen resources. The output of hydrogen in Shandong is about 2.6 million tons per year, accounting for 1/8 of China’s total, among which 960.000 tons are by-product hydrogen. Shandong has a fairly complete fuel cell vehicle (FCV) industrial chain, covering from hydrogen production, storage and transportation, refilling, as well as fuel cell core materials and components, stacks, systems, vehicles, and application scenarios. From policy perspective, Shandong attaches great importance to the development of the hydrogen industry. In June 2020, Shandong issued China’s first provincial-level medium- and long-term development plan on hydrogen energy, and total 9 local relevant standards have been deployed. In April 2021, the Ministry of Science and Technology and Shandong Provincial Government signed framework agreement on the construction of demonstrative projects of hydrogen technology, which aims to substantially widening the application scenarios.

Local Strengths

- Full coverage to hydrogen chain: Shandong covers the full range of hydrogen chain from production, storage, transportation, and application. There are over 50 key enterprises and research institutes dedicated in hydrogen, fuel cell technology and vehicles in Shandong, and the National Fuel Cell Innovation Center is newly established in Weifang, Shandong.

- Rich in hydrogen and clean energy resources: Shandong produces 2.6 million tons hydrogen per year, ranking the 1st in China, among of which 96.000 tons are by-product hydrogen. Its PV power installed capacity ranks the 1st and wind energy installed capacity ranks the 5th in the country.

- Well-developed hydrogen facility: So far 14 hydrogen refilling stations and 456 FCVs are in operation in the province. Shandong plans to have a total of 200 refilling stations by 2030.

- Policy support: Shandong issued its medium- and long-term development plan on hydrogen in 2020. Four cities in the province, Jinan, Qingdao, Weifang, and Zibo are deeply involved in the strategy as well as the framework agreement with the Ministry of Science and Technology.

Opportunities & challenges for Dutch companies

Ms. Ming Eikelenboom

Chief Representative

Netherlands Business Support Offices (NBSO) Jinan & Qingdao

[email protected]

Wuhan

The industry chain has been formed in Wuhan, from hydrogen supply, transport and storage, to application in automotive and marine vessels. Currently there are 5 filling stations in operation in Wuhan. The municipal government has the plan to build 15 refilling stations within three years. The city also plans to develop pilot application of FCEV, focus on bus, logistics van, and mid- and heavy duty trucks. It aims to have a least 3,000 FC vehicles on the road within three years.

Local Strengths

- Innovation capability: Hubei ranks No. 1 in the field of numbers of patents relevant to hydrogen and fuel cell. Wuhan University of Technology is the leading position in the field of PEM research and production. China University of Geoscience (Wuhan) develops the first hydrogen sedan in China. It also develops LOHC technology to make it possible for hydrogen storage and transport at normal temperature and pressure.

- Sufficient Hydrogen supply capability: As a traditional industrial base in China, Wuhan has rich hydrogen resource generated from its steel and petrochemical sector. For example, Wuhan Iron & Steel Group and Sinopec Wuhan refinery, have the capacity of producing around 250,000 ton hydrogen each year as its industrial byproducts. In addition, there are a number of chlor-alkali chemical plants in the province, which are also part of main source of hydrogen.

- Application in both vessels and automotive: Dongfeng Motor is one of the first group of automakers in China to engage in R&D of fuel cell vehicle. Wuhan is also an important city for fuel cell marine vessel application, as it is home to some relative important organizations, such as Wuhan Ship Classification Society (standard development) and Wuhan Ship Electric Propulsion Institute (R&D).

Opportunities & challenges for Dutch companies

Netherlands Business Support Office Wuhan

[email protected]

Hong Kong

Keeping pace with the Mainland People’s Government, the Hong Kong SAR Government announced in its 2021 Policy Address to formulate the overall strategy for achieving carbon neutrality before 2050. With power generation contributing to almost two-thirds of the city’s carbon emissions, all eyes are on the electricity sector. Due to limited renewable resources, Hong Kong would have to rely on green hydrogen imported from China or other Asia Pacific countries. Meanwhile, importing hydrogen from Mainland China could be a future solution for Hong Kong to gradually phase out fossil fuel sources.

Government priorities

- Diversifying the energy fuel mix by reducing coal and encouraging investment in renewable energies by facilitating more local projects or the regional collaboration with South China Government authorities for sustainable electricity generation.

- Promoting innovative transport such as zero-carbon vehicles and green transportation. For instance, the local bus companies will conduct trials of hydrogen fuel cell buses in the forthcoming years.

- Hong Kong Government has put climate change management and energy efficiency as the priority issues and will devote about HK$240 billion to take forward various measures on climate change mitigation and adaptation to achieve low-carbon transformation.

Local strenghts

- Hong Kong has an open business environment which are the keys for overseas companies to establish their branch office /business within China. Some keys reasons are

- a close public- private partnership; Hong Kong Government has a vital role to stimulate the business sector to reduce carbon emission to achieve its neutrality ambition by 2050. A regular quarterly meet-up with the companies and associations with the Hong Kong Government officials has been arranged since 2017 to stimulate their initiatives/ reviews on climate action plan within their operations.

- R & D funds are available for the trials of new energy commercial vehicles for the companies/ institutes in Hong Kong. For instance, a local bus company is working on the possibility of hydrogen fuel cell buses for the future decarbonisation of the Hong Kong’s public transport. The Hong Kong Government plans to test out the double deck hydrogen fuel cell electric buses in Hong Kong in the coming three years.

o no foreign ownership restrictions,

o free movement of capital, talent, goods, and information,

o low tax regime,

o strong intellectual property protection,

o English is the preferred language for business, as well as in most of the government or private companies tenders document as well.

Opportunities for Dutch companies

- Hydrogen as an Energy supply: China Light & Power (CLP) one of the two power companies in Hong Kong that will gradually upgrade to 100 percent hydrogen-fired electricity generation (to replace the existing coal-fired plants) by around 2030 by the collaboration with General Electrics (GE) to provide technology solutions and services across the entire value chain from the power generation end to the consumer end. CLP would like to obtain more info from the Dutch hydrogen technologies experts to share know-how on gas turbine retrofit to eliminate carbon emissions to 100% hydrogen fuel.

- Retrofit system: Towngas (i.e. the HK’s natural gas supplier) has been working on research and development on hydrogen production, distribution and applications since 2019. Much room for the Dutch hydrogen experts to share with Towngas on deployment and retrofitting of the hydrogen filling points at existing gas stations, as well as a safe & effective distribution system for hydrogen as a fuel cell.

- Companies in Hong Kong have been keeping an eye for hydrogen economy development opportunities. Some local companies have been carried out some trials to transport hydrogen as a fuel cell, e.g. by use of Nano-porous silicon (Si+) based H2 generator. Thus Hong Kong companies are keen to have an exchange with NL experts on hydrogen energy storage integration.

- Mobility; A feasibility study to examine the regulations & adaptations to roll out the hydrogen applications in automotive (mainly for public transport) especially for the construction and operation of hydrogen refilling stations to be launched by the Hong Kong Government in 2022. These could be an opportunity for the NL research institutes.

Ms. Betty Liu